Within the global investigation “Pandora Papers”, MANS Investigative Centre reveals how Montenegro became a safe haven for offshore affairs of the U.S. fugitive who has been sought by the U.S. authorities for years due to suspicion of illegal organizing games of chance and illegal online sports betting.

Authors: Dejan Milovac and Bojana Moškov

During only a few months of 2014, close to 900 thousand euros was paid into the bank accounts of two companies from Podgorica, and most of that money was never reported in the official financial statements. Behind those companies was Haden Ware, a U.S. citizen wanted by the U.S. authorities at the time on suspicion of illegally organizing games of chance and online betting, according to documents obtained by the MANS Investigative Centre as part of the global Pandora Papers investigation, led by the International Consortium of Investigative Journalists (ICIJ).

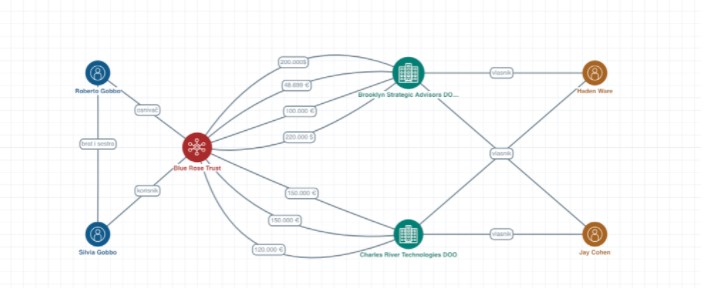

In early April 2014, Podgorica-based company “Charles River Technologies” LLC entered into a loan agreement with the Blue Rose Trust from New Zealand, which provided for a loan of 800,000 euros for a period of three years.

The first payment to the bank account of Charles River Technologies (CRT) in Crnogorska komercijalna banka, a bank from Podgorica, was made on April 9, 2014, in the amount of 120 thousand euros. It was followed by another payment of 150 thousand euros on April 22. Two days later, CRT company was formally deleted from the register of business entities, as shown by the official documentation of the Revenue and Customs Administration.

However, that was not an obstacle for the third payment in the amount of additional 150 thousand euros to be made to the bank account of the then already closed company CRT, on May 5, 2014.

After CRT was shut down, the loan agreement with Blue Rose Trust was taken over at the end of May 2014 by another company from Podgorica, called “Brooklyn Strategic Advisors” LLC (BSA), and it continued to receive payments.

On June 11, this company received the first payment to its bank account opened in Atlas Bank, in the amount of 100 thousand euros. The next instalment of the loan followed on July 2 in the amount of 200 thousand US dollars (147 thousand euros), while additional 220 thousand US dollars (164 thousand euros) was paid at the end of that month.

The final instalment to the bank account of BSA was paid on October 7, 2014 in the amount of about 48,000 euros. Thus, a total of 880,000 euros was paid into the accounts of CRT and BSA, somewhat more than provided for in the original loan agreement.

Who were the owners of CRT and BSA?

Charles River Technologies LLC was set up in early July 2011 in Podgorica by the aforementioned Haden Ware and his partner, Jay Cohen, also a U.S. citizen.

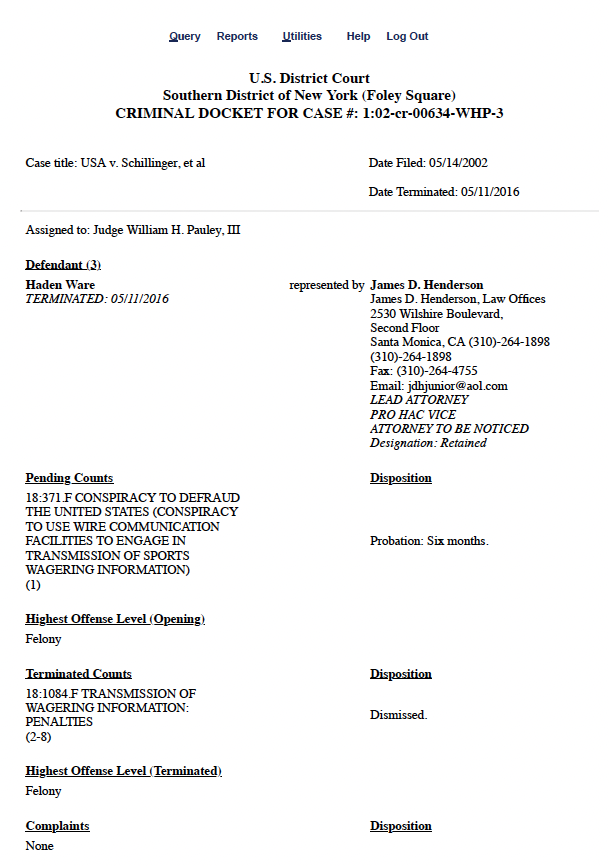

According to data from the District Court in New York obtained by the MANS Investigative Centre, Haden Ware was on the run until 2016, when he surrendered to the U.S. authorities. Ware, Cohen and 20 others were indicted in the late 1990s for illegal organizing games of chance and online gambling. U.S. authorities accused them of running an offshore company in the Caribbean that took bets from Americans over the telephone.

Prosecutors alleged that Cohen and other defendants had tried to circumvent U.S. laws by conducting their operations from gambling jurisdictions such as Curacao, Panama, Dominican Republic, Antigua and Costa Rica.

Cohen’s verdict came in 2000, after which he spent 21 months in prison, while Ware had been on the run since 2003.

However, this was not an obstacle for Ware to set up companies in Podgorica, open bank accounts and do business with trusts from offshore destinations. Official data from the Revenue and Customs Administration even show that Haden Ware was physically present in Podgorica in 2011 during the set up of the CRT company with his partner Jay Cohen, but also during its closing in 2014. Notary data show that Haden Ware used the passport of Antigua and Barbuda (Caribbean) to set up the company.

At the time of its set up, Charles River Technologies LLC (CRT) was registered at Ilija Plamenac 103/V Street in Zabjelo, while in 2014, the other company that received payments from abroad was also registered at that address – Brooklyn Strategic Advisors LLC (BSA). “Information service activities” were listed as the main activity for both companies.

BSA was founded on April 25, 2014 by a certain Oliver Vilotić with a stake of one euro. At the end of May of the same year, BSA took over the loan agreement with the Blue Rose Trust, while on July 11, Vilotić sold the company to Jay Cohen for one euro. On the same day, BSA received the first payment of 100 thousand euros.

MANS Investigative Centre tried to get a comment from Oliver Vilotić regarding the business of the company “Brooklyn Strategic Advisors” LLC (BSA) in whose set up he participated, but without success.

At the end of July 2015, Cohen sold half of his ownership in BSA to Haden Ware, who was represented in that business by Branko Šćepanović, a lawyer from Podgorica. Data from the Revenue and Customs Administration show that this time Haden was not present in Podgorica during the conclusion of the deal, but that lawyer Šćepanović acted on the authorization of Haden, who was in Argentina at the time. Half a year later, in January 2016, Haden Ware turned himself in to the U.S. authorities, where he was sentenced to probation after 13 years of fleeing the law.

At the end of December 2016, BSA was officially deleted from the register of business entities of Montenegro.

What the financial statements say

Data from “Pandora Papers” show that during 2014, the company “Brooklyn Strategic Advisors” LLC from Podgorica received payments from Blue Rose Trust in the total amount of 460 thousand euros. However, in the official financial statements for 2014 that were submitted to the Tax Administration, no information can be found about the money that came from the Blue Rose Trust. That year, the company reported only a short-term loan of about 15,000 euros.

Since its set up in 2014 until its closing at the end of 2016, BSA did not report a single euro of turnover, while official financial statements show that it did not have any employees.

In 2014, Charles River Technologies LLC (CRT) received payments totalling 420,000 euros from the Blue Rose Trust, while the financial statement for that year shows that Haden Ware and Jay Cohen officially reported only the first payment of € 120,000 thousand euros. The remaining 300,000 received from the Blue Rose Trust is not shown in the official statements of that company.

It is interesting that half of the unreported money was paid into the company’s account after it was formally deleted from the register of business entities of Montenegro.

Official financial statements show that CRT had previously borrowed money as well, so the company’s short-term loans at the beginning of 2014 amounted to close to one million euros. According to the data from the statements, from 2011 to 2014, the company employed from 16 to 35 people, and among the main costs were those for salaries, although it is not clear what were the activities of the company. Total income of this company during the four years it was registered amounted to 150 thousand euros. Revenue and Customs Administration informed the MANS Investigative Centre that CRT did not submit the financial statement for 2013.

CRT company checked by the Police Directorate

The documentation on the set up of CRT reveals that the business of that company was the subject of interest of the Police Directorate, the sector for the suppression of economic crime. Namely, at the beginning of August 2012, the then head of the Police Directorate, Branislav Živković, requested a complete documentation from the Tax Administration regarding the CRT company, including the founding acts, the statute, data on the founders and the initial capital.

The documentation shows that Živković returned the papers on CRT to the Tax Administration in early October of the same year. MANS Investigative Centre tried to get an answer from the Police Directorate to the question why the mentioned companies were inspected, what was the result of that investigation, and whether the competent State Prosecutor’s Office was informed about it, but even after several emails sent to Zoran Brđanin, the Director of the Police Directorate, we did not receive an answer.

Lawyer Branko Šćepanović, who represented Ware and Cohen in their affairs in Montenegro, told MANS that he did not know whether any proceedings had been conducted against his clients or CRT, not even by the Police Directorate.

Ware and Cohen without comment, companies without control

Owners of Montenegrin companies CRT and BSA, Haden Ware and Jay Cohen, did not answer the questions sent by the MANS Investigative Centre regarding their business in Montenegro, including those related to the reasons for setting up these companies, taking and repaying a loan from Blue Rose Trust.

We also did not receive an answer to the question whether his partner and he had been engaged in organizing games of chance or some other type of gambling services as part of their business in Montenegro.

MANS Investigative Centre received confirmation from the Revenue and Customs Administration, which is now in charge of gambling, that CRT and BSA did not address that body in order to obtain concessions for organizing games of chance, thus, no control of their business in that area was carried out.

Article 7 of the Montenegrin Law on Games of Chance stipulates that it shall be prohibited to: participate in games of chance organized abroad for which stakes are paid in the territory of Montenegro; collect stakes in the territory of Montenegro for the participation in games of chance organized abroad; as well as to sell, advertise or represent in any other way in the territory of Montenegro foreign lottery tickets and foreign tickets for the games of chance. A fine from EUR 1,100 to EUR 20,000 shall be imposed for violation of this article.

Who is behind the Blue Rose Trust

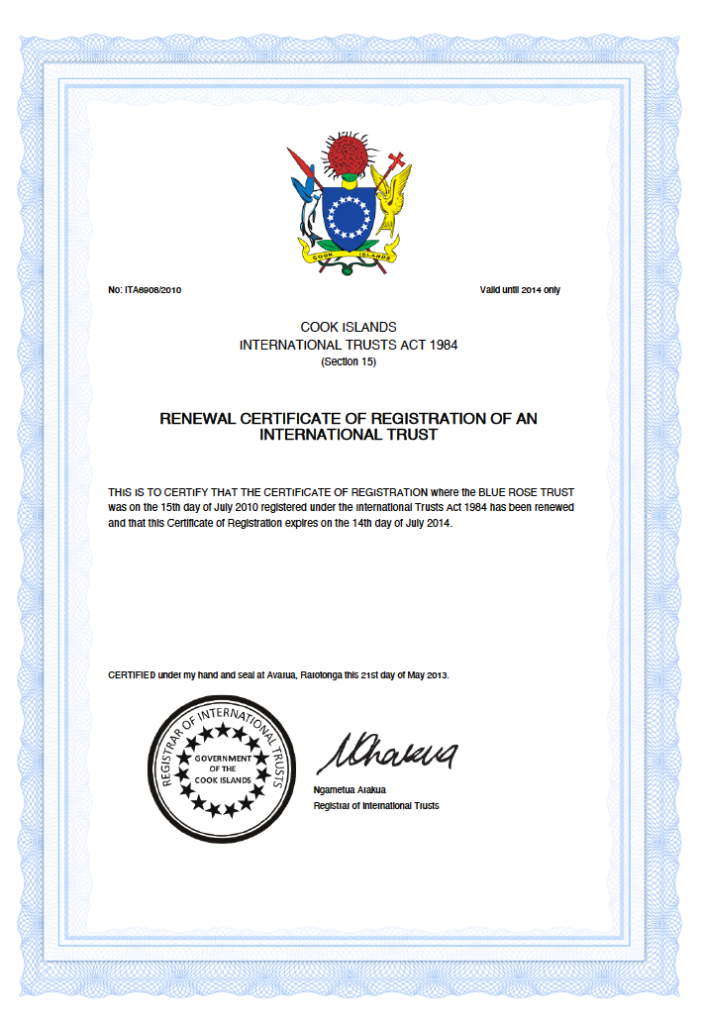

The Blue Rose Trust, whose funds were paid to Montenegrin companies owned by Ware and Cohen, was founded on July 15, 2010, by an Italian citizen Roberto Gobbo. The trust is registered in the Cook Islands, which administratively belong to New Zealand. The documentation shows that the Trust operated through a bank account opened in the Bahamas, from where the payments to the bank accounts of Podgorica companies came from.

The Blue Rose Trust, whose funds were paid to Montenegrin companies owned by Ware and Cohen, was founded on July 15, 2010, by an Italian citizen Roberto Gobbo. The trust is registered in the Cook Islands, which administratively belong to New Zealand. The documentation shows that the Trust operated through a bank account opened in the Bahamas, from where the payments to the bank accounts of Podgorica companies came from.

The documents on the set up of trust, which were obtained by the MANS Investigative Centre as part of the global investigation “Pandora Papers”, state that Roberto’s sister, Silvia Gobbo, is the only user of the trust.

Trust documentation shows that Roberto and Silvia Gobbo reside in the city of Trento, in northern Italy. While there are no more detailed data on Sylvia regarding her business, data from the Italian company register obtained by MANS show that Roberto is the owner of Qmedia s.r.l. which deals with the development of software products and performs maintenance of the clients system, predominantly those who, as stated on their website, are leaders in the gaming market and financial trading.

Qmedia also created PokerSnowie – software for poker training and learning, a version of Texas Hold’em No Limit. The software was created for the needs of Snowie Games Limited, a company registered in Malta, where Roberto Gobbo was the manager in charge of business development from 2014 to 2016.

Half a year after Ware and Cohen completed their operations in Montenegro and shut down companies, in mid-July 2017, Gobbo closed the Blue Rose Trust. In the documentation on Pandora Papers and the official financial reports of Montenegrin companies owned by Ware and Cohen, there is no information on whether and how they repaid the debt of nearly 900 thousand euros that they borrowed from the Gobbo family.

Proceedings against Ware and Cohen

In 1998, Jay Cohen and Haden Ware were accused in the USA of running an offshore online betting company, and of trying to circumvent U.S. laws by leading by organizing sports betting from jurisdictions that allow gambling. The headquarters of their company “World Sports Exchange” (WSEX) was on the Caribbean island of Antigua.

In 1998, Jay Cohen and Haden Ware were accused in the USA of running an offshore online betting company, and of trying to circumvent U.S. laws by leading by organizing sports betting from jurisdictions that allow gambling. The headquarters of their company “World Sports Exchange” (WSEX) was on the Caribbean island of Antigua.

According to the evidence presented in court, WSEX “lured” Americans through a website and a toll-free number. WSEX’s services were also advertised in American magazines, which stated that American clients could open a betting account in their company, and thus bet on American sporting events and competitions through the offshore.

During the trial, prosecutors said the disguised FBI agents had found information on manner of betting, opened accounts and bet on sports competitions using computers and telephone lines in New York.

WSEX was considered a pioneer of online betting, receiving hundreds of millions of bets a year. According to one of Cohen and Ware’s partners, they received betting stakes of $ 100 million to $ 200 million a year.

Cohen was convicted in 2000, after which he spent 21 months in prison. The indictment against Ware was filed in 2003 for the same case, but he spent 13 years on the run after the filing of the indictment. He returned to the United States on January 14, 2016 and surrendered to the District Court in New York. He was released on $ 150,000 bail before trial, and after the trial, he escaped jail and was sentenced to six months probation.

According to information available on LinkedIn, Jay Cohen now lives and works in Belgrade, in the company “Fortrade limited”, which is a provider for online trading in the global financial market, while Haden Ware lives and works in San Francisco, where he opened his consulting firm altSHIFT.

“Meet your client”

According to the Law on Prevention of Money Laundering and Terrorist Financing, commercial banks shall implement measures to establish the identity of the client, monitor customer’s business activities and control the transactions customer performs through open bank accounts, i.e. to implement measures called “meet your client”.

Article 8 of this law specifically defines the obligation for a bank to collect data on the nature of business relations of its clients and the purpose of transactions that take place through their accounts. Banks were also required to implement these measures particularly in cases of “executing one or more linked transactions in the amount of €15, 000 or more”.